Municipal Audit Law Update

By: Dacia Smith, Oregon Audits Division

The Special Districts Association of Oregon supported House Bill 2110, which passed in the 2023 legislative session to amend Municipal Audit Law. Municipal Audit Law requires Oregon’s local governments to file an annual financial report and audit with the Oregon Secretary of State.

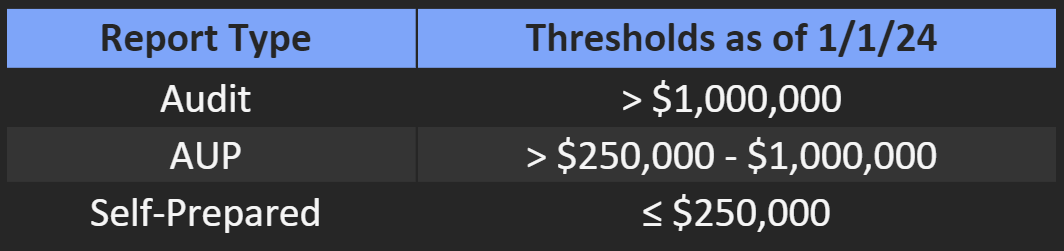

Many of the recent legislative changes update terminology to clarify statute or better align with current practice or professional standards. Some of the changes are more significant, such as increased thresholds for audit exemption, introducing a new report type, and increased filing fees. A key legislative change replaces mid-level review reports with agreed-upon procedures (AUP) reports.

As a result, the Administrative Rules and Minimum Standards for Reviews are being amended to reflect the change to AUP reports. Public comment on the proposed Oregon Administrative Rules (OAR 162-040) is open until 5:00 p.m. on Tuesday, October 3. Districts are encouraged to submit comments or attend the virtual public hearing at 11:00 a.m. on Tuesday, September 26, 2023. Changes are effective for fiscal years ending on or after January 1, 2024. Additional information about these changes include:

Updated thresholds: Audits have always been required for counties and school districts. They are now required for entities spending more than $1 million annually — an increase from $500,000. All other entities may be eligible for an audit exemption. Entities spending less than $250,000 may be eligible to file a self-prepared report in lieu of audit. Other audit exemptions, including timely reporting and fidelity bond requirements, are unchanged.

Agreed-Upon Procedures (AUP) reporting: Municipal auditors will be required to perform and report results of procedures that address certain components of compliance, operations, and financial reporting. The AUP report does not provide an opinion or conclusion.

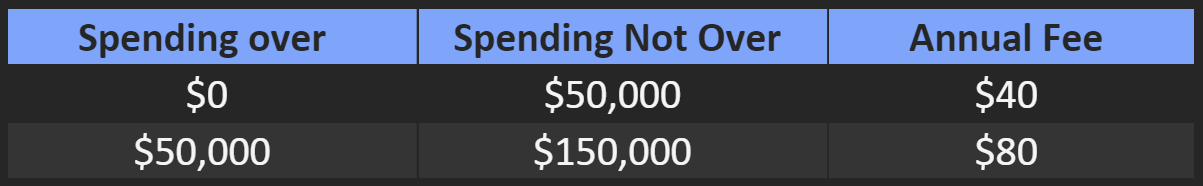

Filing fees: As determined by entity spending, increased fees will range from $40 to $500. This is an increase cost between $20 to $100 compared with current filing fees.

Verbal comments on the proposed rules can be submitted to the Secretary of State Audit Division Rules Coordinator at: (971) 394-3559.

Written comments on the proposed rules can be submitted electronically to the Secretary of State Audit Division Rules Coordinator at: Julie.A.SPARKS@SOS.OREGON.GOV.

Written comments can be sent by United States postal mail and must be received on or before Tuesday, October 3, 2023, to the following address:

Secretary of State Audits Division, Rules Coordinator

255 Capitol St NE STE 180

Salem OR 97310

Additional information on the legislative changes, including notice of proposed rulemaking, is online at: sos.oregon.gov/HB2110